rhode island state tax rate 2020

Form T-79 must be filed along with Rhode Island estate tax return if if the decedent had. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

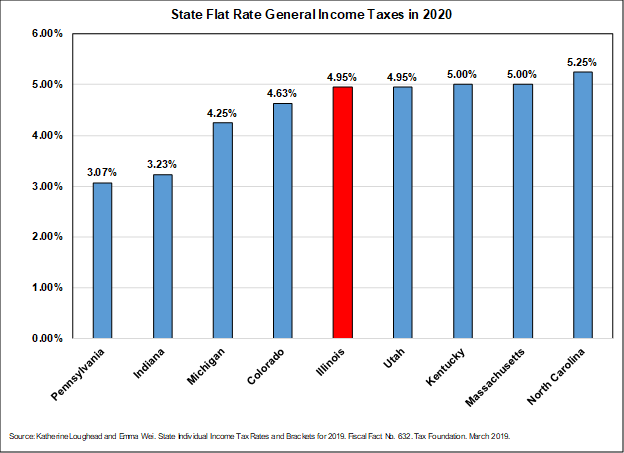

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax.

. 375 on up to 66200 of taxable income High. The top rate for the Rhode Island estate tax is 16. Ad File Your State And Federal Taxes With TurboTax.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Including Rhode Island incorporated stock Rhode Island state and municipal bonds and mutual funds organized as business trusts that do business in Rhode Island. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in late December of their individual tax rate.

To have forms mailed to you please call 4015748970 or email TaxFormstaxrigov. See Why Were Americas 1 Tax Preparer. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

The average effective property tax rate in Rhode Island is the 10th-highest in the country though. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax. 2016 Tax Rates.

Start filing your tax return now. It kicks in for estates worth more than 1648611. Find your gross income.

The state did not levy any local sales taxes meaning that the total sales tax was 700 percent. The Rhode Island tax rate is unchanged from last year however the. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

Find your income exemptions. For decedents dying on or after 112020 with a gross estate of more than 1579922. The table below displays the state tax rates average local tax rates and average combined tax rates for Rhode Island and its neighboring states.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. Current and past tax year RI Tax Brackets. Rhode Islands tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

Rhode Islands state sales tax was 700 percent in 2017. 2022 New Employer Rate. 2022 Rhode Island state sales tax.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. About Toggle child menu. Detailed Rhode Island state income tax rates and brackets are available on this page.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. TAX DAY NOW MAY 17th - There are -451 days left until taxes are due. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

See If You Qualify To File State And Federal For Free With TurboTax Free Edition. 2020 Tax Calculator. Rhode Island Tax Brackets Rates explained.

Rhode Island Income Tax Rate 2022 - 2023. Exact tax amount may vary for different items. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Information on how to only file a Rhode Island State Income Return. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format.

Ad Access Tax Forms. Rhode Island Income Tax Range. 599 on taxable income over 150550 For 2022 the 375 rate applies to the first 68200 of taxable income.

The Rhode Island state income tax is based. Rhode Island Tax Brackets for Tax Year 2020. If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a financial advisor can help you whether your planning an estate or dealing with any other financial.

Most forms are provided in a format allowing you to fill in the form and save it. All Rhode Island state taxes are deductible from gross income when calculating federal taxes so any Rhode Island corporate income tax paid can be deducted from a business gross taxable income before calculating your federal taxable income. Both the state income and sales taxes are near national averages.

State of Rhode Island Division of Municipal Finance Department of Revenue. Counties and cities are not allowed to collect local sales taxes. Click on the appropriate category below to access the forms and instructions you need.

Complete Edit or Print Tax Forms Instantly. Find your pretax deductions including 401K flexible account contributions.

U S Sales Taxes By State 2020 U S Tax Vatglobal

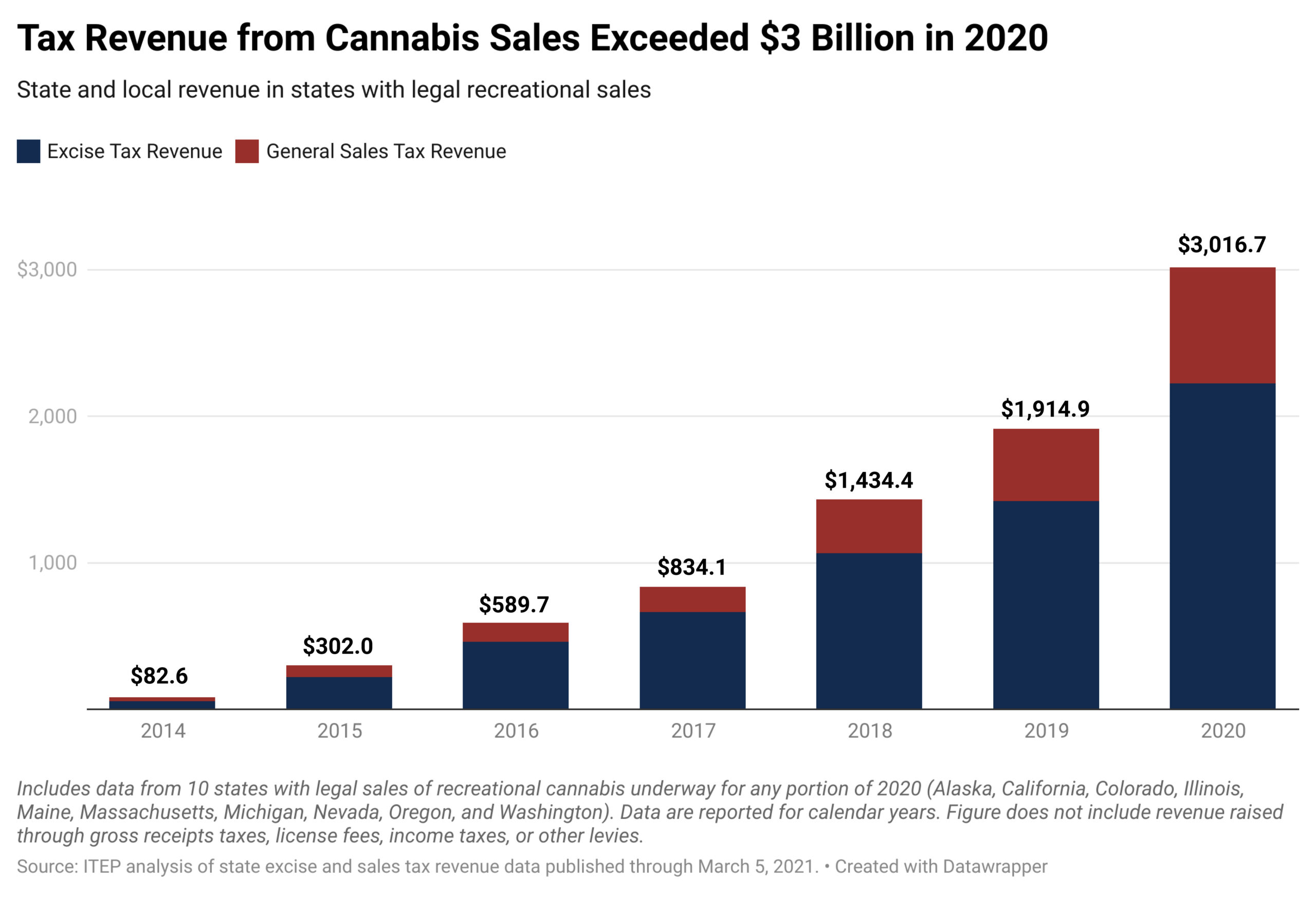

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

These States Have The Highest And Lowest Tax Burdens

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Low Tax States Are Often High Tax For The Poor Itep

State Income Tax Rates Highest Lowest 2021 Changes

A Visual History Of Sales Tax Collection At Amazon Com Itep

States Are Imposing A Netflix And Spotify Tax To Raise Money

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Individual Income Tax Structures In Selected States The Civic Federation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Sales Tax On Grocery Items Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)